All these indicators then point to the fact that the fisheries sector, one which consistently forms 3-5% of the total contribution of the agriculture sector (between 20-40%) to the national GDP and with an expanding industrial base of a growing economy demanding more of fish by-products, where average GDP per capita reaches $4,000 pushing purchasing power up, will see tremendous growth into the nearest future.

Note: This article was first published on LinkedIn, March 8, 2020.

Circumstances in Nigeria today and around the world present the Nigerian fisheries sector opportunities to see massive growth, to undertake rewarding heroic cause, and also make it a very good place for investment under agriculture than any other time in the history of Nigeria. Here are four reasons to believe this:

1. The current domestic demand for fish in Nigeria is on the high side at 3.32 million metric tonnes with the nation’s capacity of 1.123 million MT unable to satisfy the demand.

Consequently, Nigeria spends nearly USD 1 billion annually on importation to fill the demand-supply 2.197m deficit, earning her the largest fish importer of the developing world.

This is that the nation having spent an estimated ₦125 billion on fish importation in 2015, seeking to boost her fish production capacity in tandem with the goal to achieve food sufficiency, in the following year disbursed through its Central Bank in conjunction with a domestic financial institution, Heritage Bank, a 2 billion long-term loan which the aquaculture company, Triton Farm, seized to erect a 25,000 MT aquaculture facility.

It makes it evident measures -and even policies -are being put in place to ensure the country reaches food sufficiency level.

Presently the federal government, technically, has banned the importation of food that can be produced in the country by cutting special forex rate that aids their importation in an effort to encourage and foster local food production. The fisheries sector, one very much affected by importation, is expected to benefit immensely from this step.

A huge demand-supply gap, hungry market, entrance ease, coupled with favourable policies and business environment hence offer highly rewarding opportunities for entrepreneurs and investors.

2. Nigeria’s population has been growing at its fastest, at a rate of 2.6% yearly (although now decelerating), currently 200 million and is expected to double its present state by 2050.

The population is a young one with a median age of 18.1 years. By the end of 2020, 62.9% of this population would be in the age range of 0-24 years.

Aside the concerns of feeding sustainably the overall fast-growing population with the needed food calorie for a vibrant nation, providing the required protein and nutrients in their recommended daily allowance for a teeming young population to enable their proper development and a thriving future generation is another concern for the nation.

For a rapidly growing population whose average per capita protein intake (51.7g) is lower than the FAO’s 60g per person minimum recommendations and with 50% of it extremely poor to access required food protein, fish with its affordable nature and yet high-quality protein provides a readily available energy-protein, animal source, to sustain the projected population size and demographic.

It already accounts for 35-40% of animal protein in the country and nearly 75% in rural region having highest incidence of people living in hunger and poverty.

The demand for fish (protein) in the nation, above 2 million MT, is bound to grow bigger, opening up opportunities for investment and more participation in the sector.

3. In Nigeria today, there are over 26 million undernourished people (World Bank Development Indicator, latest estimates 2018). Also, about 2.5 million Nigerian children battle severe, acute malnutrition.

41% of the nation’s children under the age of 5 is affected by protein-energy malnutrition (PEM), a malnutrition disorder which occurs due to inadequate calorie and protein intake. Two important forms of PEM are kwashiorkor and Marasmus.

Fish containing a wide variety of nutrients -minerals, vitamins, fat, carbohydrate, water, protein -forms adequate meal/food supplement to prevent and cure PEM.

Fish protein contains essential amino acids (Lysine, Leucine, Valine and Arginine), it is a good source of fat-soluble vitamins (B complex), water soluble vitamins (A, D & E) and also other macro and trace nutrients (Calcium, Phosphorus, Iron, Iodine & Selenium), all vital for proper development and functioning.

It is no surprise the body UNICEF has been experimenting and encouraging in the developing world, substitution of costly milk protein for cheaper and effective alternatives like fish in Ready to Use Therapeutic Food (RUTF).

Already, the Federal Government of Nigeria had been tackling malnutrition, disbursing in 2019 USD 1.8 billion for RUTF, and with UNICEF support.

With increasing prevalence of malnutrition, selective forex for milk importation feeding into hike in milk price, and (necessitating) more inclusion of fish protein in RUTF, demand for fish is expected to climb where the fisheries sector drives the moral cause to end malnutrition.

4. Overnutrition is increasingly a common problem in the world and not just in the developed economies where food is surplus, but also in developing countries facing food insecurity.

Nigeria for instance, a nation having 13.4% of her population undernourished, is blighted with obesity epidemic 8.9% prevalence among adults where it takes a gender turn, affecting 25% of women.

In addition, across the world (the WHO monitoring overnutrition), obesity prevalence among adults is reported to be on the rise with half a billion of them obese and over 1.9 billion adults of age 18 and above, overweight; 42 million children under the age of 5 have been classified overweight or obese.

These dangerous statistics bring concern on poor food choices causing health issues like obesity which in turn aggravates serious heart related problems as hypertension, cardiovascular diseases.

There is thus a move towards healthier food options in the world -not just access to food but to a balanced, nutritious one -as reinforced by the SDGs and FAO definition of food security.

With fish rich in healthy fat having omega 3 fatty acid, low in cholesterol and available in a readily absorbable form that prevents the risk of heart-related diseases, fish diets/ingredients are increasingly seen as better alternatives where policies are being tailored to ensure their incorporation in meals and drugs (e.g. Omega-3 supplement).

This encourages investment in the domestic fisheries sector and with opportunities for trade with, export to countries aligned in said policies.

Therefore...if you are wondering where to be in the nation's agriculture sector, that promises a hungry market and a good return on investment, with statistics and projections presented so far it makes sense the fisheries sector definitely is the place to be and with catfish part of the aquaculture sub-sector the best destination.

All these indicators then point to the fact that the fisheries sector, one which consistently forms 3-5% of the total contribution of the agriculture sector (between 20-40%) to the national GDP and with an expanding industrial base of a growing economy (averaging 2% growth rate annually), the largest in Africa, demanding more of fish (raw materials and by-products for glue, cream, oil, drug etc. making) where average GDP per capita reaches USD 4,000 pushing purchasing power up, will see tremendous growth into the nearest future.

Nonetheless, while the fisheries sector is presented with such opportunities, the fish culture aspect of it will be the main driver to utilise these opportunities and yield returns.

Fish culture was not only the game changer in the sector, it made possible the increase availability of select-fishes available for various special purposes today without sustainability and environmental issues.

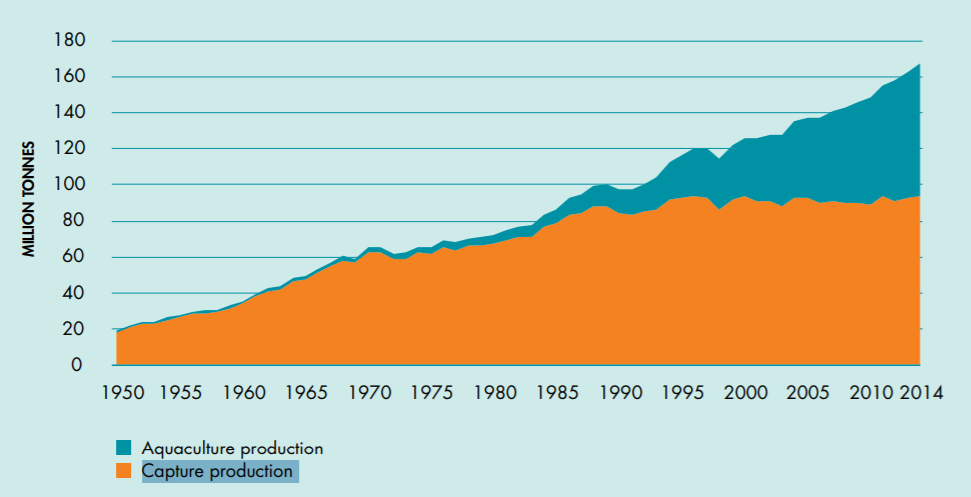

Across the world the practice of fish capture in water bodies has been stagnating (see Fig 1) and even declining in some regions, owing to issues of fish scarcity with catching frequency exceeding population regeneration level, environmental degradation and climate change, and consequently, with government regulations.

Fish culture made it possible to grow to maturity, the same fish species in artificial water containment and even in greater numbers, faster and sustainably.

Source: The State of World Fisheries and Aquaculture 2016, FAO

Also, when fish culture is being talked about, catfish rearing is the single most important activity that has made fish culture increasingly common and readily practiced today in this part of the world.

It is not only because catfish delicacy is highly sought for its palatability and healthy, beneficial properties and uses, but also for reasons of its ease of production, rapid maturity, high fecundity, adaptability and profitability compared to other fishes.

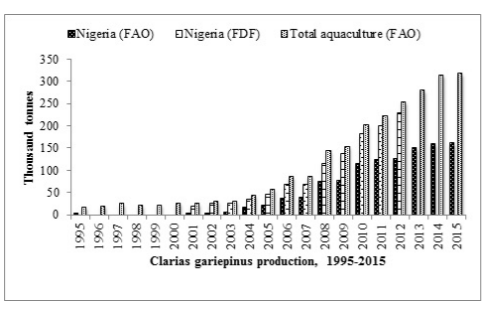

Fish culture is the fastest growing livestock production in Nigeria where catfish aquaculture part of it has grown, more than any other sub-sector of the fish culture unit, by 721% between 2001 and 2015 from 19,518 tonnes to 160,295 tonnes [data presented is for only African catfish (Clarias gariepinus), and was reached from a 2001-2012 time-frame rare assessment of catfish aquaculture in Nigeria by the Inter-African Bureau for Animal Resources, African Union, and of a 2016 report on Nigeria Catfish Industry by the Food and Agriculture Organisation (see Fig 2)], which forms half the nation’s overall 316,727 tonnes aquaculture by volume. With addition of the production of other catfish hybrids overtime, catfish’s total contribution to the Nigerian aquaculture sector rises to 80-90%.

Therefore [to answer the question posed in the beginning of this article] if you are wondering where to be in the nation’s agriculture sector, that promises a hungry market and a good return on investment, with the statistics and projections presented so far it makes sense the fisheries sector definitely is the place to be and with the catfish part of the aquaculture sub-sector the best destination.

Catfish industry contribution to the economy has not only been in the form of providing needed food, protein for food security, raw materials to catalyse industries, but also generating employments, revenue and foreign earnings for government and income for farmers.

Based on the 2016 FAO’s catfish production figure (adapting metric of the earlier AU-IBAR report where every catfish production tonne generates an employment) jobs created by catfish sector (for African catfish) equals approximately 200,000, more than 300,000 jobs considering other hybrid species and would have leveled 1 million today (adjusting for growth overtime).

In the same report, the sector saw a USD 1.3 billion domestic earning, where value-added products of the fish destined for international markets constituted 7% of the estimated USD 284,390 million total fish exports earnings.

Engaging in the sector is thus contributing to the growth and development of the country. What then are the lucrative aspects of the industry that can be invested?

There are three distinct part of catfish aquaculture across the value chain:

1. Breeding:

This involves the breeding of catfish fish seed stock (from eggs to fries, fingerlings, juveniles and even post-juveniles) for grow-outs production.

It is usually done in a hatchery, where catfish brood stocks are artificially induced with hormones to produce eggs.

There is a huge demand-supply gap for catfish fingerlings in Nigeria. There exist in the nation a demand of more than 4.3 billion. Only 55.8 million of this is being met. This provides opportunity for investments, and with good returns.

Under ideal conditions a good brood stock can give up to 60,000 eggs/kg where survival rate to fingerlings can be 75% with standard and properly managed nursery system.

Fingerling is sold for ₦15 while post-fingerling ₦20. Thus if 45,000 fingerlings or post-fingerlings survive from 60,000 eggs, that is ₦675,000 or ₦900,000 returns respectively, in the expectation that cost of production would be subtracted.

The extent to which one profits then depends on the capacity to which one can produce, successfully manage production, and also access market.

Credit: Nature’s Bliss Nig Ltd

2. Production:

It entails the raising of fingerlings, juveniles, post-juveniles -whichever of them one decides to start with -to maturity.

There are different mediums for intensive production; earthen pond, concrete pond, with other innovative ponds; plastic pond, metallic pond and concrete pond.

All support catfish rearing till maturity, but the earthen pond offers a natural habitat advantage which enables catfish attain exceptional sizes and weights, although with its own cons too.

Catfish reaches table size in 4-6 months when well fed with the needed, quality feed. In this time period, with proper feed and favourable conditions they attain a weight range between 0.5kg to 2kg.

Catfish is sold in range of ₦500-₦800/kg (varies with location). A 1000-stock with 10% mortality attaining an average weight of 1.5 kg each would yield at ₦650 mean price, ₦877,500 (that is, 900 x 1.5kg x ₦650).

The main costs here are feeding and pond construction, where new pond is built. As for breeding, production profitability also is dependent on capacity of production and to access market and in addition, cost expended on feeding.

Catfish raised in Tarpaulin Pond, ready for market

Credit: Iceberg Agricultural Consult Ltd

3. Value addition:

This is the process of adding value to catfish through processing, preservation, addition of flavours and other beneficial nutrients, and packaging.

It helps to command good price in the market and even access a high paying market.

Also, it extends the shelf life of catfish produce and, with quality preservation and enhancement, allow for accessing foreign markets.

The key processes are degutting, filleting, washing, salting, cutting into preferred sizes or folding into a round shape and smoking by oven, adding special nutrients which could also be preservatives but edible, and then packaging.

The value-added catfish products are sold at retail outlets, food stores, even on online retail stores, where collection points are around the country.

A kg of packaged smoked catfish can go as high as ₦4,500 (6-9 times price for the same kg of live fish, although it would take more of the latter to reach the same kg, result of weight loss to smoking).

Moreover, there are huge untapped markets abroad, in China, Europe and USA; however, required high quality standards are to be adhered to.

Smoked catfish’s price in the international market is between USD 30 and 40/kg. It is reported by the Food and Agriculture Organisation that smoked and dried fishes with retail value of about USD 20 million are exported to the United Kingdom annually from West Africa and of the 500 tonnes equivalent, Nigeria accounts for one-eight.

Credit: Nature’s Bliss Nig Ltd

Despite the high demand for catfish delicacies, the profitability and the ease of engaging in any of the three distinct stages of catfish value chain, many people who have gone into production still encountered failure and/or have struggled to break-even and have left business. Two factors top reasons for this:

1. Market/Marketing:

A lot of people who enter catfish value chain do not make market well informed decisions, they simply follow trend of what is in vogue or listen to hearsay of how a particular part of catfish production is lucrative and then commit to production.

While there may be demand for catfish everywhere in the country, the level of demand and even need might not necessary be the same for different regions; even a market with good demand might require different strategies.

Imagine joining a market that has a good demand for catfish but where enough research was not done to realise there are already many primary producers with established markets and high entry barrier, whose aggregated produce causes glut and force down price.

If enough market research were done, the best decision would be to produce what differentiates one from the other producers -perhaps focusing on processing one’s catfish and targeting high end customers like food stores.

Even when one still wants to be involved in primary production, with the understanding of a saturated market rather than selling to final consumers like the competitors, one would know to find different customers and even high paying ones like restaurants, hotels, schools.

Thus, when production decision is not market-led the producer with no reliable market is left to sell at lower prices, leave fishes in the pond while they are still being fed, or left to die and money burn/investment waste. The bottom line is, many people do not bother to know their market in-depth, analyze it and, on that basis, decide what to produce, what strategy to deploy, and have their market before production.

2. Professional knowledge and Management skills

In-depth knowledge that has to do with everything about catfish value chain or the part of the value chain one is interested in is very important for the success of the envisaged venture.

For instance, for catfish grow outs, knowledge of the different growing mediums to be able to select the best, where to site the fishpond, the requirements (water quality, stocking density) is vital.

Also important is the knowing of the best fish seed stock to use for production, the daily activities and occasional maintenance, the required and best feeds and practices.

Knowledge of all this allow for a successful raising of catfish from fingerlings to table size with little mortality.

Many people have unknowingly procured and raised runts/bad stocks that do not grow or take time to grow while feeds are being wasted on them, have raised catfish in the wrong medium, stocking density, conditions and have realised high mortality.

Or imagine starting a hatchery business with little or zero knowledge about it where mortality rate at the early lives (as fries) of catfish is up to 80% and sometimes 100% if care is not taken. Or processing and packaging catfish for export with inadequate grasp of the value addition processes and the quality standard required for exporting.

The United States on March 1st, 2018, banned smoked catfish export from Nigeria for the breach of the required certification standard. 40% of smoked fish export from Africa to US and EU are detained, confiscated or returned due to this reason, which is a massive loss on investment made.

Thus, it is very important before engaging in any stage of catfish value chain to first make effort to gain the necessary knowledge and skills –they can be gained from farms of those already practicing -so as to enable a smooth operation and ensure profit on investment to be made.